How to Make a Credit Card

Michael Spelfogel

In the journey to building Cardless, countless people said the idea wasn’t possible or dismissed our naivete. Once we gained traction, they started to try and copy us. A common misconception in our space is that the winner takes all. We get asked by VCs all the time about other startups, or even specifically about Stripe. Ironically, our biggest competitor is neither startup nor legacy player, it’s people’s propensity to use cash. Notwithstanding the fact that approximately 99% of revenue in credit cards is earned by traditional issuers in the United States, the next 150% of spend doesn’t occur on cards at all. Our single minded goal is to win the unstoppable march to a digital future. Let the best product win. Here’s how we’re making ours.

A bit about me

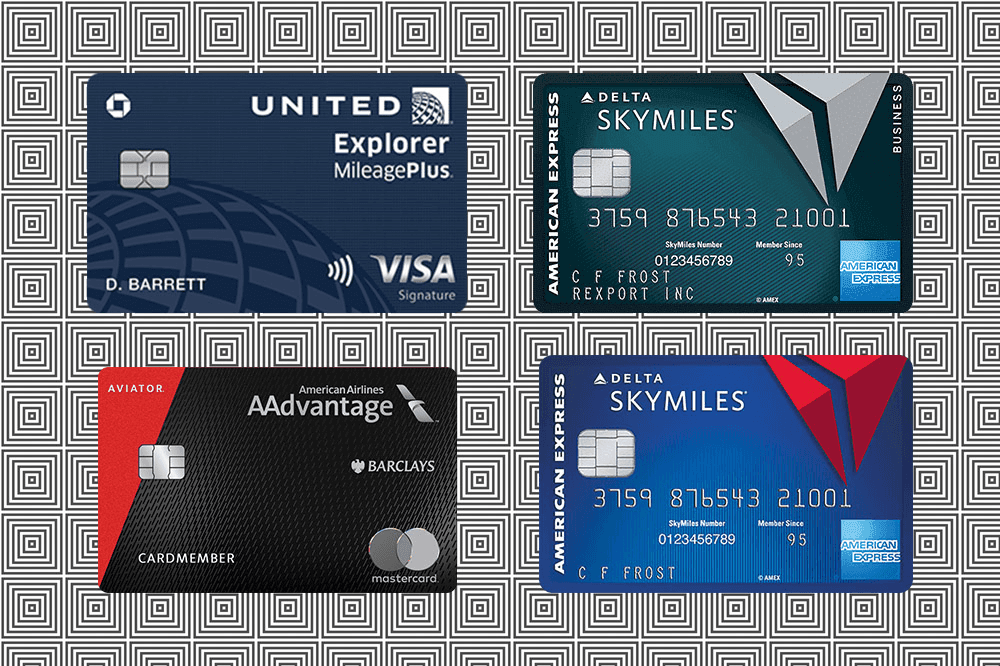

I applied for my first credit card the day I turned 18 years old. It was to get a free flight back home to New York for Thanksgiving break from college at Stanford. The credit card signup bonus earned me 25,000 Delta SkyMiles, just enough to cover round trip airfare from San Francisco. The points served an obvious utility: getting to see my family and friends after moving across the country months earlier.

Later that fall I applied for my second card. This one was less for utility; it was for curiosity. After my second approval I stumbled on The Points Guy. I got hooked. I was shocked that as a student with a modest internship salary, I was able to get multiple cards.

That Christmas, I applied for four credit cards on the same day — all approved. Now, it was sport.

Scaling the hobby up

Part of me loves testing and tinkering with systems, so the following year I really pushed the boundaries. I began applying for cards with multiple credit bureaus frozen so that my credit score would only be hit by new applications one bureau at a time. I continued to acquire more cards.

My sophomore year at Stanford I met my co-founder Scott while studying abroad in Beijing. I quickly convinced him to apply for more credit cards. He helped me push the limit of the systems I liked to test through automation. That year I also began working at The Points Guy. While I didn’t realize it at the time, those first months planted the seeds for something much bigger.

Becoming my profession

My latest credit card, my 243rd, is quite different from all the others. It is my own — The Cleveland Cavaliers Mastercard by Cardless. The card is immediately remarkable for not having physical numbers on it, but it also represents the work from more all-nighters than I care to admit.

Scott and I started Cardless over two years ago. Working at Lyft, I realized just how broken the credit card space was when they decided to scrap a years-long credit card initiative. We hypothesized that there should exist a startup that lowers the barriers to entry and helps brands launch and run successful card programs. And after two years of grinding away, Voila! We actually launched a credit card. Seems easy enough right? Bloomberg, WSJ, Sportico, and even my favorite av-geek blog View From The Wing wrote about us. But what actually goes into making a card?

The ingredients

A Credit Card is three things: An issuer, a lender, and a servicer. Traditional banks often try to do all three of these functions under one roof. Our company relies on ripping these tasks apart.

Banks are bad at Servicing. Our closest competitor has a negative NPS , their average call center hold time is 30+ minutes, and to this day in order to submit documentation for a dispute, you need to find yourself a fax machine. Tech companies though, have a unique opportunity to build a good customer experience. Banks just don’t try. They don’t have to try; or rather, they didn’t have to try. Cardless designed it’s servicing with our cardholders first — like call back functionality: Call in and cardholders either get a human asking how they can help on the first ring, or a message that says “We’ll call you back when it’s your turn in X minutes”. Our app is intuitively designed and our product is structured to align incentives with customers, not against them.

Next up is Issuing. For both legal and practical reasons, a FDIC insured bank has to stand behind every credit card belonging to a payment network (Visa, MasterCard). Our bank is First Electronic Bank, a Utah based Industrial chartered bank which has a history of working with Fintechs. The bank relationship is often make-or-break for many startups, and since there are only a handful of issuers in the US with a history of partnering with tech companies, our bank partnerships are critical. Managing the compliance risk of a program is often overlooked, but consumer credit cards present a ton of complexity which also helps reward those who understand and prioritize solving the complexity.

Lastly there’s Lending. This is where we get the most creative. Traditional banks often have a small and defined credit box they adhere to when acquiring customers. Some love super-prime, other’s target prime and a few thrive in sub-prime ranges. The issue is that brands have customers from all walks of the credit spectrum. It has been reported that Uber for example may have had a low digit approval rate on its credit card program. Indeed, this is one of the critical reasons innovative brands like Lyft chose not to launch cards. They’d be alienating a majority of their customer base when attempting to serve it in the first place. That’s why on the backend, Cardless is building a different kind of lending marketplace relying on a diverse set of lenders who can capture different parts of the credit spectrum. The more lenders, the higher the approval rate and the larger percentage of a brand’s customers we approve.

Broken apart, the core tenets of credit cards actually form an adhesive and durable product that aligns incentives with consumers and the brands they love.

The recipe

Actually putting these pieces together takes a ton of precision and a little secret sauce. Here’s the recipe (excluding things like fundraising and hiring — the cookbook assumes you’ve got an oven after all).

Secure an issuer (You’ve got about 10 options)

Find debt financing for the credit receivables (Insert modeling)

Forge network relationships (Visa, Mastercard)

Get your card processor (you only have a couple to choose from)

Get your card printer (we’re not all digital just yet)

Allocate your BINs and integrate your settlement process

Integrate fraud, KYC, OFAC, AML, credit underwriting, and platform vendors to decision applications

Build a product that convinces your issuer to let you launch your program

Design the card value proposition, the APR, and the line size in a way that captures a specific demographic

Market your product and get people excited about it

Monitor for fraud, both systematic and transaction based

Continually incentivize your cardholder to not forget you in the abyss of the credit card space

Don’t forget to raise more debt, or you’ll grow too fast to sustain your program

Cook for 18–24 months, then it will be ready to go!

How to serve

Now you have a functioning credit card company. Congratulations! Credit cards and networks represent a half a trillion dollars of annual revenue, so there’s a lot to tackle here. For starters, actually care about your customers; don’t charge late fees for example. That’s doing something that most traditional banks can’t offer. We lead by example and provide fundamentally better and more innovative products that help to push the envelope of growth. Ultimately, we’re nothing without our brands and their superfans so our mission is simple: Connect superfans with the brands they love.